Create a professional CV now!

NO

NO YES

YESOur customers were hired by:

Navigating through the numbers, credit controllers play a strategic role in any business, ensuring financial stability and customer compliance. This article dishes out essential tips and examples to craft a compelling credit controller CV that stands out.

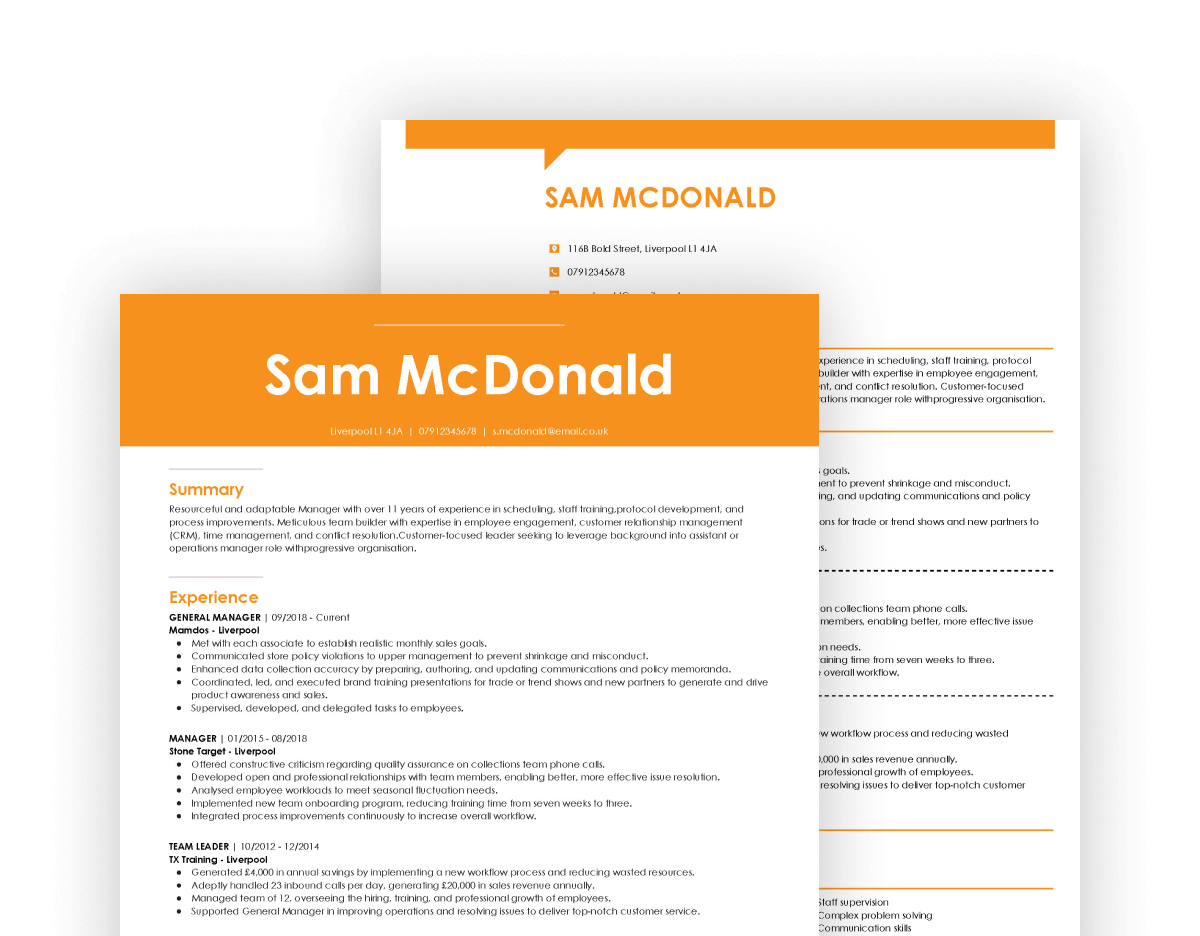

Create an effective CV in minutes. Choose a professional CV template and fill in every section of your CV in a flash using ready-made content and expert tips.

Create a professional CV now!

NO

NO YES

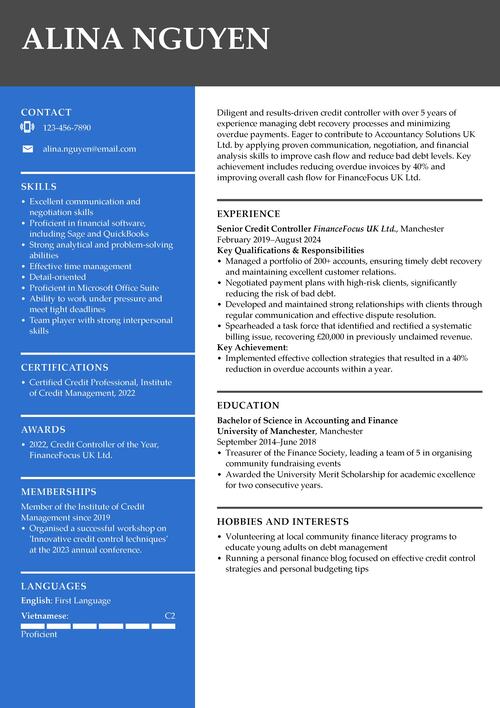

YESWe created the sample on the right using our builder. See other good CV examples like this one.

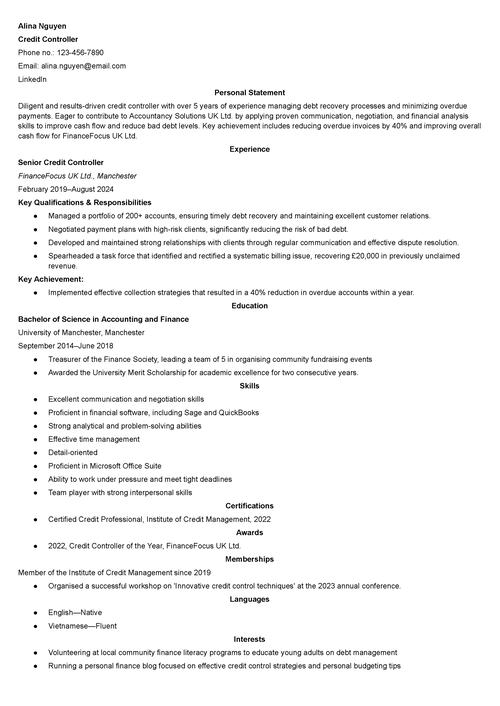

Here’s a credit controller CV sample in a text version:

Alina Nguyen

Credit Controller

Phone no.: 123-456-7890

Email: alina.nguyen@email.com

Personal Statement

Diligent and results-driven credit controller with over 5 years of experience managing debt recovery processes and minimizing overdue payments. Eager to contribute to Accountancy Solutions UK Ltd. by applying proven communication, negotiation, and financial analysis skills to improve cash flow and reduce bad debt levels. Key achievement includes reducing overdue invoices by 40% and improving overall cash flow for FinanceFocus UK Ltd.

Experience

Senior Credit Controller

FinanceFocus UK Ltd., Manchester

February 2019–August 2024

Key Qualifications & Responsibilities

Key Achievement:

Education

Bachelor of Science in Accounting and Finance

University of Manchester, Manchester

September 2014–June 2018

Skills

Certifications

Awards

Memberships

Member of the Institute of Credit Management since 2019

Languages

Interests

In this guide, we’ll uncover the key elements of crafting a CV tailored to credit controller roles. Discover how to present your experience and skills in a way that showcases your value to potential employers.

Create a persuasive personal statement that outlines your experience and specialisation in credit control. There are 2.5 million jobs in the finance sector and the competition for talent is high. Prove you’re worth considering by recalling a career achievement that significantly helped a previous employer.

Tailor the work experience section of your credit controller CV to spotlight your expertise in credit control, including achievements and relevant experiences using the PAR (Problem, Action, Result) formula. Include 3 to 7 bullet points under significant roles, incorporating job titles and employer names.

Augment your credit controller CV by listing your educational background. Format it as [Degree Class] [Degree Name] (Year Graduated) at [University Name]. For those less experienced, include a bullet-point list of relevant achievements, extracurricular activities, and excellencies.

Detail relevant hard skills, soft skills, and computer knowledge in a dedicated section. Ensure these skills align with what employers in the credit control field are looking for.

Enrich your credit controller CV with sections that add more depth, such as certifications or language abilities, keeping the focus on the essentials. You may also include hobbies or interests as long as they’re relevant to the financial sector. For example, show that you’re learning about green finance and trying to gain green skills.

Enhance your application with a tailored cover letter that reflects your unique qualifications and enthusiasm for the role. Begin with a concise introduction, then illustrate your strengths and contributions. Conclude your cover letter with an earnest statement of interest and a proactive call to action.

Experiment with the layout of your credit controller CV, choosing a clear font and sufficient white space for easy reading. Ensure your CV is compatible with applicant tracking systems, considering file format constraints—PDF files might sometimes pose compatibility issues.

A finely tuned credit controller CV opens doors to new opportunities and sets the foundation for a successful job hunt.

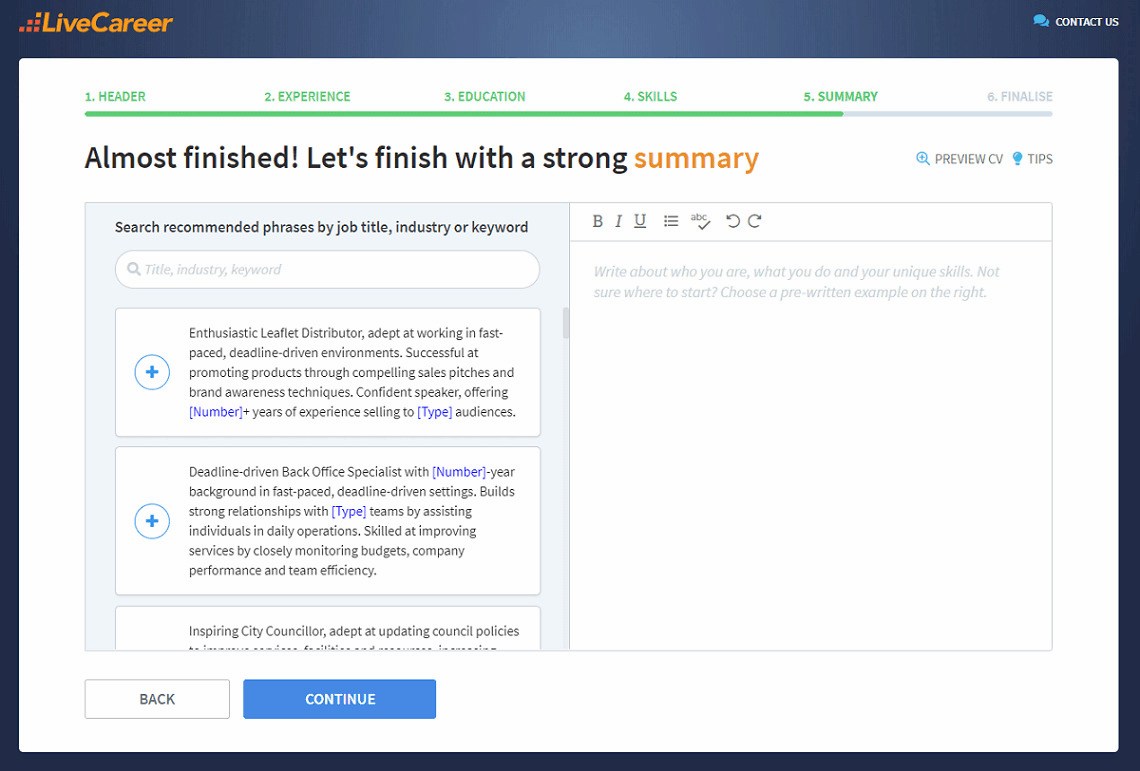

A strong CV summary will convince the recruiter you’re the perfect candidate. Save time and choose a ready-made personal statement written by career experts and adjust it to your needs in the LiveCareer CV builder.

Considering other positions? See CV examples for different jobs:

Thank you for taking the time to read our guide on crafting a credit controller CV. We hope it serves as a valuable resource in your job search. If you have questions or would like to share your own tips, please use the comment section below.

Our editorial team has reviewed this article for compliance with LiveCareer’s editorial guidelines. It’s to ensure that our expert advice and recommendations are consistent across all our career guides and align with current CV and cover letter writing standards and trends. We’re trusted by over 10 million job seekers, supporting them on their way to finding their dream job. Each article is preceded by research and scrutiny to ensure our content responds to current market trends and demand.

About the author

LiveCareer UK CV builder is powered by career experts, CV writers, and HR professionals. Since 2013, our editorial team has supported job seekers with free, research-based career advice and expert tips to improve their job applications. LiveCareer UK CV builder has already helped thousands, and you can be next.

Rate this article:

Credit controller

Average:

Learn how to write a CV in a few steps. Make a good CV for the UK job market following a dedicated CV template, expert tips, and examples.

How do you write a promising CV for finance jobs? Check out our expert finance CV examples and tips on finance CV templates, specific to the UK job market.

See how you can get your accountant CV ready for the Big Four. Check expert accountant CV example, template, and tips to nail your next interview.

Our customers were hired by: